- Smashi Business

- Posts

- Dubai Crypto Scene Gets a Boost; Perfume Turns to Gold for Al Majed Oud; ADIA Sets Up Shop in India

Dubai Crypto Scene Gets a Boost; Perfume Turns to Gold for Al Majed Oud; ADIA Sets Up Shop in India

Wednesday, October 9, 2024

Hello, Smashi Business readers! 🌟

Today, we are discussing:

🚀 DMCC & Cointelegraph Partner to Boost Dubai’s Crypto Hub

📈 Almajed Oud’s Stock Soars: Hits 50% Increase Post-IPO on Tadawul

💼 UAE’s ADIA Launches Operations in India’s GIFT City

Let's dive in! 👇

🚀 DMCC & Cointelegraph Partner to Boost Dubai’s Crypto Hub

📰 What is it about?

DMCC (Dubai Multi Commodities Centre) has partnered with Cointelegraph to open its regional office at the DMCC Crypto Centre.

Cointelegraph’s presence in the centre will connect it with the largest crypto and blockchain business community in the region.

This partnership will enhance media and marketing opportunities for companies and provide preferential access to Cointelegraph's platform.

💡 Why it matters?

Dubai is positioning itself as a global Web3 and crypto innovation hub, and the DMCC Crypto Centre is a focal point for this growth.

Cointelegraph’s involvement brings credibility and visibility to the local ecosystem, encouraging more blockchain startups to set up operations.

The collaboration supports the Cointelegraph Accelerator program, aiding new blockchain businesses with resources and regulatory support.

🔜 What’s next?

Cointelegraph will host events, workshops, and networking initiatives to develop the regional Web3 community.

DMCC will continue expanding its ecosystem, leveraging partnerships like this to attract and support more blockchain companies.

The presence of Cointelegraph is expected to foster global collaborations and accelerate Web3 adoption in Dubai and beyond.

📈 Markets

🔼 EGX 30 | 30,851.63 | -3.04% |

🔽 DFMSI | 2,567.81 | +1.02% |

🔼 ADX | 9,258.71 | +1.222% |

🔼 Tadawul | 12,027.17 | +0.95% |

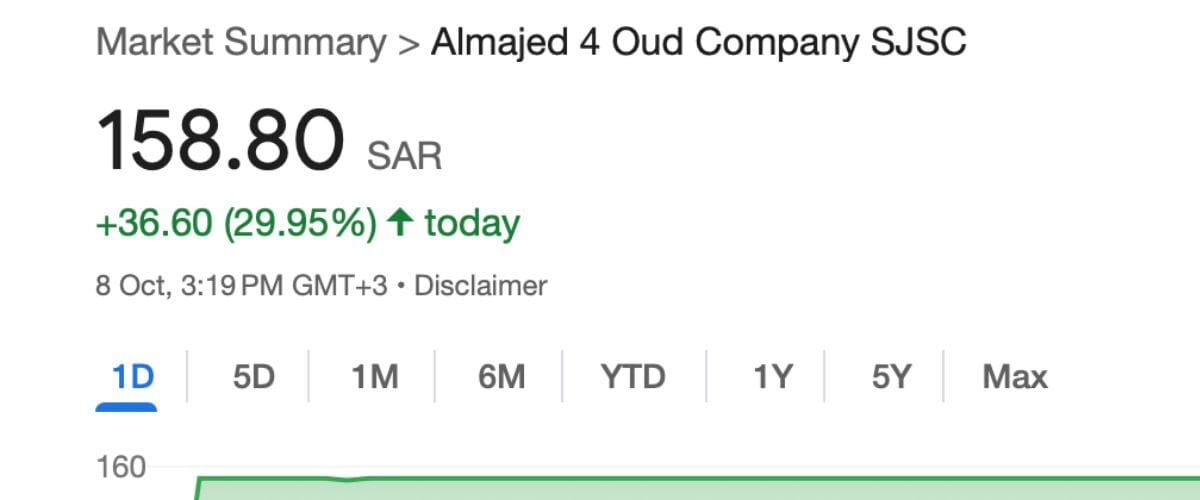

📈 Almajed Oud’s Stock Soars: Hits 50% Increase Post-IPO on Tadawul

📰 What is it about?

Almajed Oud's shares surged 30% on their first trading day on Tadawul, rising from SAR 94.0 to SAR 122.2.

On the second day, the stock climbed over 50% compared to its initial listing price.

The stock hit the maximum ±30% trading limit during intraday, a rule that applies for the first three days before adjusting to a ±10% limit.

💡 Why it matters?

Almajed Oud’s IPO raised SAR 705 million, with a market cap of SAR 24 billion upon listing, highlighting investor interest despite recent profit declines.

The strong performance reflects confidence in the brand and its expansion, despite a 22% decline in Q2 2024 net income to SAR 55.5 million.

The stock’s oversubscription rate—15.6x for institutional and 8.2x for retail—signals high demand and market confidence in the company’s growth potential.

🔜 What’s next?

After the three-day period, trading volatility is expected to stabilize as the limit reduces to ±10%.

Almajed Oud may face pressure to maintain momentum and improve profitability despite increasing revenues from seasonal boosts like Hajj.

Investors will likely monitor upcoming quarterly earnings and expansion strategies to gauge long-term growth and stock performance.

Quote of the day

“Sooner or later, those who win are those who think they can.” - Paul Tournier

💼 UAE’s ADIA Launches Operations in India’s GIFT City

📰 What is it about?

The Abu Dhabi Investment Authority (ADIA), the UAE's largest sovereign wealth fund, has begun operations in India’s GIFT City.

GIFT City, located in Gujarat, is India’s emerging tax-neutral finance hub aimed at attracting global capital and financial services.

The hub offers tax incentives, including a 10-year holiday for companies and no taxes on fund transfers from abroad.

💡 Why it matters?

ADIA’s presence in GIFT City aligns with its strategy to tap into India’s growing market and economic potential.

The UAE has been the biggest Arab investor in India, with investments totaling around $3 billion in the fiscal year 2023-24.

The move highlights India's efforts to make GIFT City a global financial hub, enhancing its appeal to international investors and funds.

🔜 What’s next?

ADIA is setting up a $4-5 billion fund to invest in India through GIFT City, focusing on long-term opportunities in the country.

The hub is expected to attract more foreign capital as it benefits from India’s strategic location and economic growth.

With ADIA’s launch, other international players might follow, boosting GIFT City’s profile as a gateway for global investments into India.

In other news…

Oil prices climb to $80/barrel amid Middle East tensions and also US’ hurricane Milton concerns.

American State Street is expanding operations in Dubai and Saudi Arabia.

Egyptians will be able to use 5G services soon.

The Latest from the Smashi Business Studio

👋 Hello, That’s Me - Your Content Buddy

What is Odeum?

Odeum is Augustus Media’s innovative in-house content studio, where creativity meets data-driven insights to produce compelling new media formats. Specializing in connecting brands with communities and culture, Odeum offers a range of services tailored to your needs.

Why Do Brands Need a Content Strategy?

An authentic story is key to connect with audiences on a personal level. That’s why a well-crafted social content strategy helps brands resonate with the internet generation and earn their trust.. Odeum excels in modern content creation, offering expertise in social media management and access to fully equipped studios.

How Can You Get Started?

If you’re a brand with a vision, contact us here, and our team will get in touch to help you bring your ideas to life.